With the release of our fifth annual OfferUp Recommerce Report, our excitement around the recommerce industry’s future has never been higher. With millions of new users buying and selling every day, the industry is continuing to experience persistent growth. What’s more, we’re seeing the rising popularity of resale lead to a notable decline in the stigma once attached to buying pre-owned, whether it’s tied to purchasing items for personal use or gift-giving.

Our 2023 report found that 85% of shoppers regularly buy and/or sell secondhand, an increase of 3% from last year, with 27% of them doing so for the first time, helping push the recommerce market’s projection to $276B by 2028.

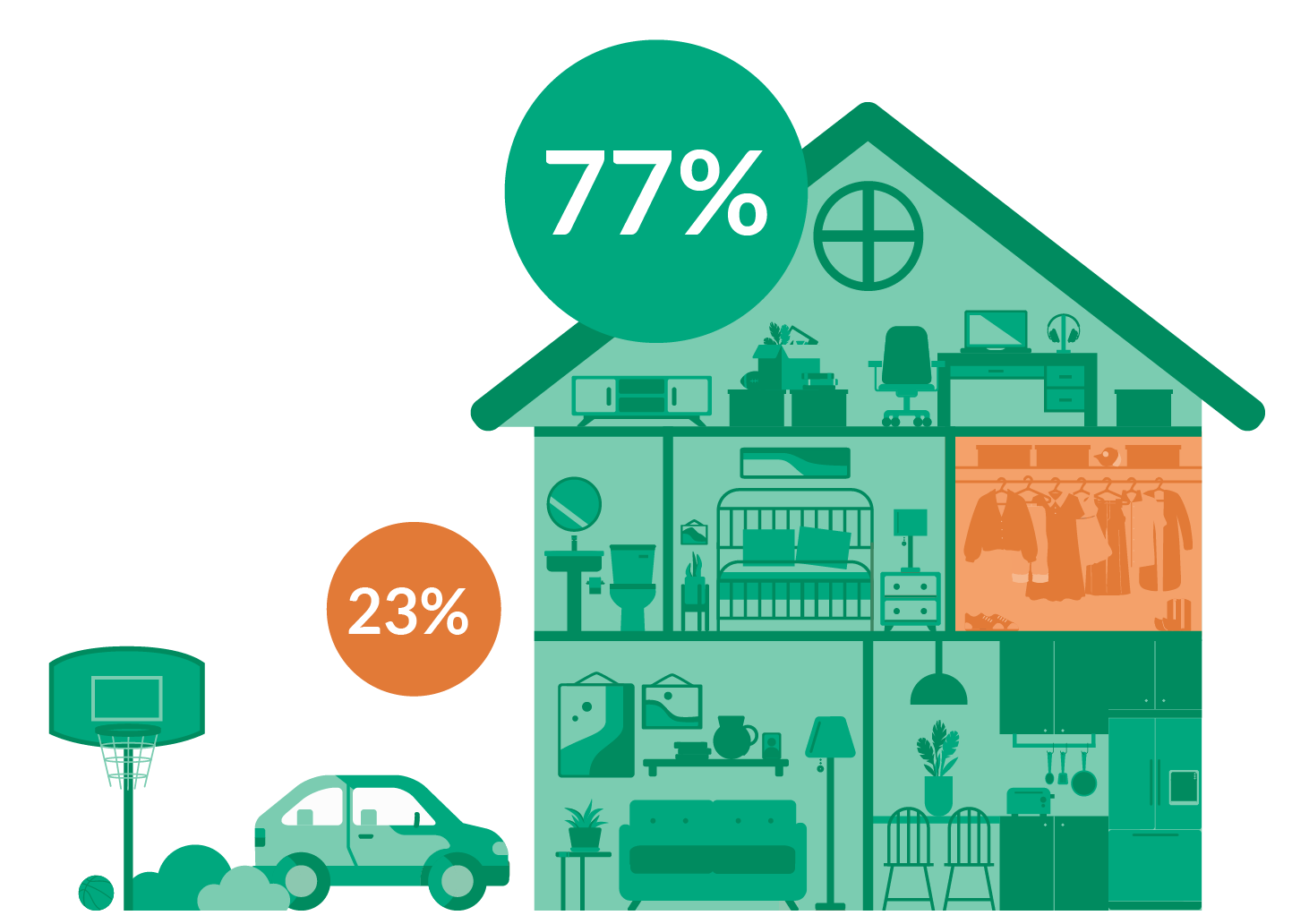

The data also paints a picture of an increasingly diverse recommerce market, with 77% of transactions extending beyond apparel. Only 23% (less than 1 in 4) of the items sold through recommerce are clothing, while the remaining 77% is predominantly represented by categories such as electronics, furniture, home goods, home improvement, sporting goods, outdoor equipment, and auto parts.

Furthermore, our report uncovers changing perceptions that are ultimately driving this sector’s growth. We surveyed a representative set of Americans and found that 76% of shoppers believe the stigma around secondhand shopping has decreased and that 41% say that buying secondhand is now considered a status symbol.

OfferUp remains the largest mobile marketplace for local buyers and sellers in the U.S., and we have continued to see healthy buying and selling activity across the categories outlined in this report. I’m proud that OfferUp is at the center of these promising trends as the industry continues to grow and mature, and I’m confident that the best is yet to come.

Todd Dunlap

CEO, OfferUp

Key Findings

Secondhand Shopping

Rises in Popularity

and Status

Our 2023 consumer survey reveals that 76% of shoppers say the stigma around secondhand shopping has decreased, citing more affordable options (57%), changing societal attitudes towards consumption and waste (55%), and increased availability and variety of secondhand items (54%).

Our 2023 consumer survey reveals that 76% of shoppers say the stigma around secondhand shopping has decreased, citing more affordable options (57%), changing societal attitudes towards consumption and waste (55%), and increased availability and variety of secondhand items (54%).

With resale now firmly embedded in mainstream culture, recommerce spending is projected to reach $188.5 billion by the end of 2023. This exponential growth is fueled not only by the increasing acceptance of resale but also by the continuous influx of new buyers and sellers entering the market.

Looking ahead to 2028, the recommerce market is projected to reach $276 billion—a 58% growth rate—and is also expected to outpace the overall retail market by 4.4%. By 2028, recommerce is projected to account for 8% of the total retail market, reflecting a 2% increase compared to 2023 and indicating people are increasingly directing their spending toward secondhand products.

77% of Resale Happens In Categories Outside of Apparel

As the popularity of purchasing secondhand rises, shoppers are rapidly increasing their adoption of pre-owned goods beyond just clothing.

77% of recommerce happens in categories outside of apparel, such as electronics, furniture, home goods, home improvement, sporting goods, outdoor equipment, and auto parts. In fact, apparel makes up only 23% of the total recommerce market*.

* Global Data 2023 Market Sizing and Growth Estimates

On average, respondents have acquired 21% of their belongings through secondhand shopping in the past 12 months, compared to just 9% throughout their lifetime.

On average, respondents have acquired 21% of their belongings through secondhand shopping in the past 12 months, compared to just 9% throughout their lifetime.

Most Popular Items People Shop for Secondhand:

As Prices Remain High, Value Continues to Be the Strongest Driver for Buying Resale

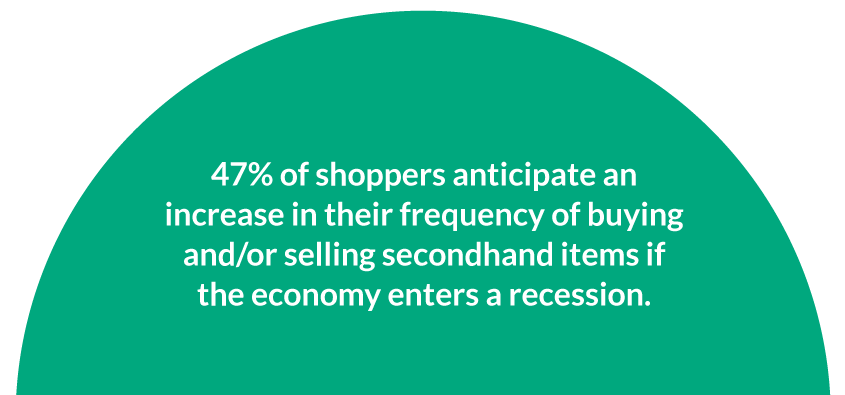

With economic uncertainty still top-of-mind for many shoppers, recommerce has remained a popular and valuable resource for those looking to find items at more affordable prices.

Top 3 Reasons Consumers Shop Secondhand

Americans Turn to Reselling as a Way to Make Ends Meet

The growing popularity of resale shopping has also extended to sellers; 27% more recommerce sellers entered the market in 2023 compared to 2022.

of sellers have used money earned from reselling items to pay for bills or everyday living expenses.

say reselling has helped them make ends meet.

Top 3 Reasons People Sell Secondhand

Online Resale Platforms Gain Preference Over Retail Among Shoppers

Buying and selling secondhand is not just an affordable way of shopping but rather a conscious lifestyle choice. In particular, online resale platforms have made shopping for secondhand items quick and easy, bringing a new level of convenience to the process.

Online Resale Platforms Gain Preference Over Retail Among Shoppers

Buying and selling secondhand is not just an affordable way of shopping but rather a conscious lifestyle choice. In particular, online resale platforms have made shopping for secondhand items quick and easy, bringing a new level of convenience to the process.

Top Reasons People Find Buying on Online Resale Platforms More Convenient Than Retail

Secondhand Gifting Gains Momentum As Shoppers Embrace Pre-Owned Presents for the 2023 Holiday Season

The Top Three Categories for Secondhand Holiday Gift Purchases

Secondhand Gifting Gains Momentum As Shoppers Embrace Pre-Owned Presents for the 2023 Holiday Season

The Top Three Categories for Secondhand Holiday Gift Purchases

Affordability Challenges Drive Surge in Secondhand Holiday Shopping

of shoppers have or plan to sell items on online resale platforms this year to better afford holiday gifts.

As shoppers increasingly turn to secondhand options to manage their holiday budgets due to financial concerns, the overall strain on holiday spending extends to a broader scale. In fact, 46% of shoppers have noticed that prices for the gifts they want to purchase are notably higher than in previous years. Additionally, 32% are encountering greater difficulties in finding holiday bargains this year.

The Top Three Factors Affecting Shoppers’ Holiday Budgets this Season

The Top Three Factors Affecting Shoppers’ Holiday Budgets this Season

Affordability Challenges Drive Surge in Secondhand Holiday Shopping

of shoppers have or plan to sell items on online resale platforms this year to better afford holiday gifts.

Methodology

The OfferUp Recommerce Report includes research and data from retail analytics firm GlobalData. GlobalData uses consumer surveys, retailer tracking, official data, data sharing, store observation and secondary sources to analyze, model and calculate metrics including market and channel size, and market share.

Third-party online market research company Pollfish conducted a June 2023 survey of 1,500 U.S. adults.

Additional data sources include internal OfferUp community data and independent secondary research.

SOURCES

1 OfferUp, 2022 Recommerce Report

© OfferUp, Inc. 2023

Methodology

The OfferUp Recommerce Report includes research and data from retail analytics firm GlobalData. GlobalData uses consumer surveys, retailer tracking, official data, data sharing, store observation and secondary sources to analyze, model and calculate metrics including market and channel size, and market share.

Third-party online market research company Pollfish conducted a June 2023 survey of 1,500 U.S. adults.

Additional data sources include internal OfferUp community data and independent secondary research.

SOURCES

1 OfferUp, 2022 Recommerce Report

© OfferUp, Inc. 2022

Methodology

The OfferUp Recommerce Report includes research and data from retail analytics firm GlobalData. GlobalData uses consumer surveys, retailer tracking, official data, data sharing, store observation and secondary sources to analyze, model and calculate metrics including market and channel size, and market share.

Third-party online market research company Pollfish conducted a June 2023 survey of 1,500 U.S. adults.

Additional data sources include internal OfferUp community data and independent secondary research.

SOURCES

1 OfferUp, 2022 Recommerce Report

© OfferUp, Inc. 2023

Methodology

The OfferUp Recommerce Report includes research and data from retail analytics firm GlobalData. GlobalData uses consumer surveys, retailer tracking, official data, data sharing, store observation and secondary sources to analyze, model and calculate metrics including market and channel size, and market share.

Third-party online market research company Pollfish conducted a June 2023 survey of 1,500 U.S. adults.

Additional data sources include internal OfferUp community data and independent secondary research.

SOURCES

1 OfferUp, 2022 Recommerce Report

© OfferUp, Inc. 2022